What Is a Personal loan? Who couldn’t use a little extra money to consolidate credit card debt, modernize their home or pay for their wedding or other big-ticket item? One smart solution is a personal loan, which typically offers fixed rates and lower minimum borrowing amounts than other financial vehicles. Because of these and many other benefits, personal loans are trending with 11% year-over-year growth.

Is a personal loan right for you? Well, here’s what you need to know.

What makes a personal loan so appealing is that it can offer a fixed interest rate and typically lower minimum borrowing amounts. That being said, it’s not for everyone. Learn what a personal loan is, how it works and whether it’s the best choice for you.

What Is A Personal Loan?

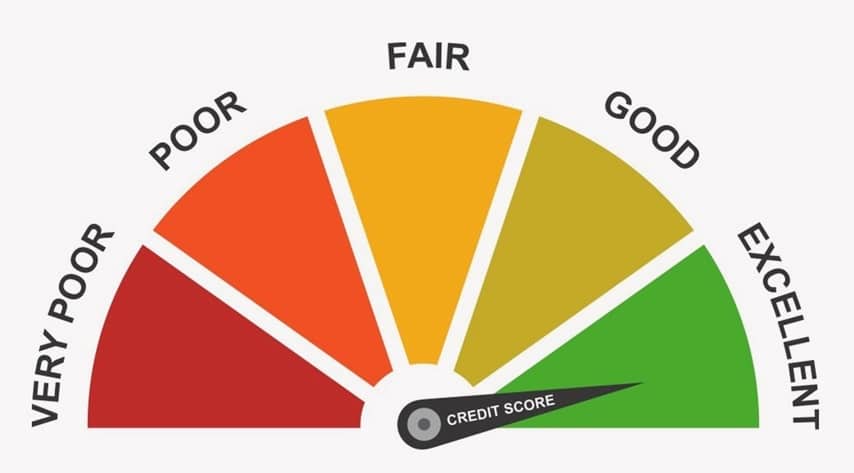

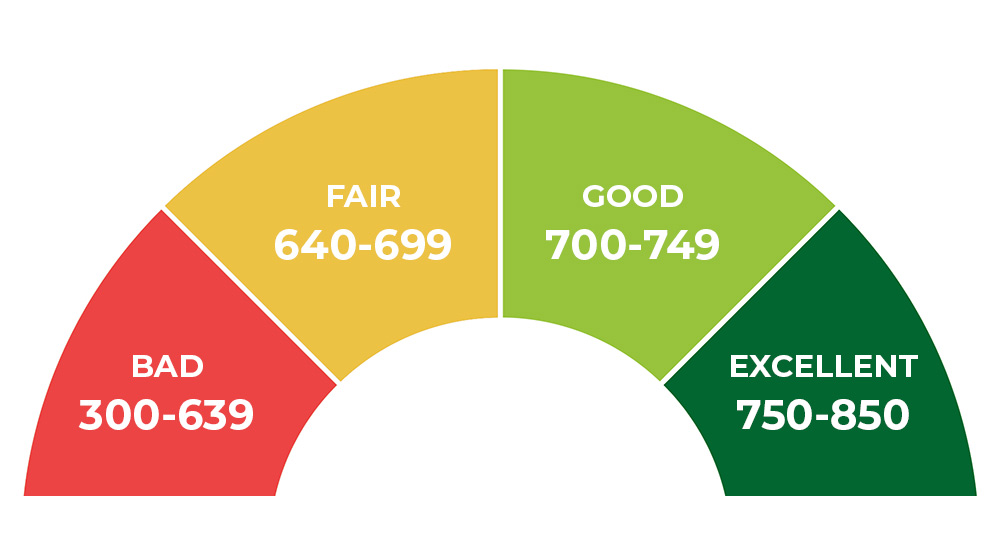

A personal loan is a type of credit known as an installment loan, where you borrow a specified sum of money from a bank, credit union or online lender with a fixed interest rate and pay it back within a predetermined amount of time. Your interest rate will vary depending on your creditworthiness – the higher your credit score, the lower your rate will be, meaning you will pay less over the life of the loan.

Personal loans are personal, meaning that you can use a personal loan for a wide variety of reasons. According to the Experian™ survey above, the top three reasons that people took out personal loans were for large purchases (28%), debt consolidation (26%) and home renovation projects (17%).

But that’s not all! There are many other reasons why people may apply for a personal loan.

What Can You Use A Personal Loan For?

Personal loans can be used for myriad reasons.

Here are some of the most popular ways people tend to use personal loans:

Pay Down Medical Bills

If you can’t negotiate high medical bills for lower terms, a personal loan allows you to pay them off so they don’t ding your credit. You’d then pay the personal loan back in installments.

Consolidate Debts

If you have multiple loans with high interest, you can combine them into one personal loan as a method of debt consolidation, to help make payments more manageable and possibly achieve a lower interest rate. Debt Consolidation can include student loans, credit card debt or tax debt.

Finance A Vehicle

It pays to shop around, but some personal loans may have lower interest rates than auto loans you might find at the dealership.

Fund Your Small Business

Whether you’re expanding your operation or need to take on extra marketing expenses, a personal loan can help your small business move forward.

Plan A Wedding Or Vacation

These once-in-a-lifetime events add up, and a personal loan can often help cover the expenses more affordably than using a credit card. Same goes for those who celebrate the holidays.

Make Home Renovations and/or Repairs

If you have small repairs or home improvements you want to make and don’t want to take out a home equity loan, a personal loan can be a great way to cover the costs.

Use a personal loan to finance exactly what’s needed for turning your house into a home.

How Do Personal Loans Work?

Let’s do a quick overview of the personal loan process.

Getting Approved

To see if you qualify for a loan, first check your credit, as that can be an important decision-making factor for the lender. To apply for a personal loan, you’ll need to submit your financial information to lenders. The lenders will look at your credit score, your income, your debt-to-income ratio, your employment history and your savings.

Once you choose one, you’ll supply more detailed information, and your lender will consider your suitability. Within days, you’ll receive your approval, if all goes well, along with all the repayment terms.

Loan Terms

Once you are approved, you will receive a Promissory Note that defines the loan terms and conditions. Make sure you read this document carefully, as it lays out all the agreements between you and your lender. It will tell you, among other things, when payments need to be made, the applicable interest rate, and whether there are prepayment penalties and late payment penalties.

It will also tell you how long it will take you to repay the loan and will specify when and to whom payments will be made. Once it’s signed, it is a contract that governs the relationship between you and your lender.

Before you sign on the dotted line, make sure you understand all the terms of the loan:

- How much the interest rate is – while usually the interest rate is lower than other types of loans, they can still be high, especially if you don’t have a stellar credit score.

- Whether there’s an origination fee, which is what some lenders charge to process the loan. This is typically a percentage of the loan amount and may be rolled into your monthly payments or paid upfront.

- How long the loan team is – the longer the loan term, the more interest you’ll be paying. You can pay off your loan early, but some lenders charge a prepayment penalty – a fee for making early payments.

- Your total monthly payment – make sure you can commit to paying this amount on time each month for the life of the loan, otherwise you could be looking at late fees and potential negative marks on your credit report if you fall seriously behind.

Repayment

Once you receive the loan proceeds, you will simply make payments until it is repaid. When you complete your repayment, the Promissory Note you signed will be returned to you and you will no longer be obligated on the loan.

Types Of Personal Loans

There are loans available in all shapes and sizes to meet your needs.

Secured Personal Loan

A secured loan is backed by some type of collateral, such as your vehicle or a savings account. If you don’t make your payments, the lender has the right to take that asset to pay off the personal loan. Secured loans tend to carry lower interest rates because lenders have that asset to tap should you default.

Unsecured Personal Loan

By contrast, an unsecured personal loan isn’t backed by collateral, which means that a lender will decide whether you qualify based on factors like your credit history and income. If you have bad credit, an unsecured personal loan can be harder to get, because lenders won’t be as confident you’ll pay it back.

Fixed Rate Vs. Variable Rate Loans

Personal loans can charge a fixed or variable rate of interest.

If you choose a fixed-rate loan, you lock in at an interest rate and then your payments are equal over the term of the loan. If you choose a variable rate, you may pay a lower interest rate initially, but you are taking the risk that interest rates will rise and your monthly payments will go up, although you could also benefit from lower monthly payments should interest rates fall.

Co-Signed Loans

If you have little or no credit history, lenders may require you to have a co-signer on the loan.

This means that you will need someone to vouch for you, and to promise to pay your loan off should you default. Co-signers are generally very close relatives, like parents or partners. Your co-signer will also have to submit their financial information so the lender can decide whether they are able to repay your loan.

Personal Line Of Credit

If you’re not sure how much you’ll need to borrow, or the expenses will be spaced out over time, you may want to consider a personal line of credit.

Similar to a credit card in that you are only charged for what you use during the borrowing period (or the time in which you are able to draw from the account), you need only pay interest on what you’ve used. If you don’t end up borrowing the full amount you’ve been approved for, you aren’t charged interest as you would have had you taken an unsecured personal loan for the full amount.

Debt Consolidation Loan

With a debt consolidation loan, borrowers roll their high-interest rate loan payments – generally credit card debt – into a new loan.

Some lenders will send the loan proceeds directly to your creditors to save you the step of repaying them yourself. To make this worthwhile, you need to make sure that the APR of your new loan is less than the APRs of your current debt. You’ll also need to fix the underlying spending problem that led you to assume that debt in the first place.

How To Shop For Personal Loans

Most of the hunt for good loan terms starts and ends on your computer.

Go Online To Identify Best Offers

When you decide you need a personal loan, you should start shopping online to see what’s available. It’ll help if you know exactly what you’re looking for and how much you need to whittle down the various products available.

Compare APR To Shop For Loans

When you start evaluating loan offers, you’ll want to compare the Annual Percentage Rate, or APR on each one. We tend to think of the interest rate as the cost of the loan, but some lenders artificially lower their interest rates by tacking on fees.

The APR takes all fees and charges into account so you can compare apples to apples when evaluating the loan offer. Lenders are required to disclose the APR on all consumer loans.

Should You Take Out A Personal Loan?

The answer to this question depends on your personal circumstances, your financial philosophy and your spending habits. If you’re in doubt about whether it’s worth it, have a conversation with a financial advisor to help you decide.

For some people, getting a personal loan can be a great strategy to simplify complicated bills and roll several high-interest debts into one that may have a lower interest rate. Not only will it be much easier to pay just one bill instead of several, but you could save hundreds, if not thousands of dollars over the life of your loan, thanks to that lower interest rate.

Sometimes, as in the case of medical expenses, the costs of the loan are subordinate to the crisis in front of you. Or if you find that you’re in a tight bind – such as needing a new car to be able to get to work – then a personal loan might be needed.

Whether the benefit of obtaining a personal loan outweighs the costs can be a tough decision, and in some cases, an emotional one. Do you research, discover your options, and talk things over with a trusted friend or financial advisor before committing to a loan offer.

How Invest Loans Ltd. Can Help

We are Invest-Loans Ltd. Learn more about our company, personal loan services and whether a personal loan works well for you and your finance situation.